GCash for OFWs in Dubai: An In-depth Guide to a Perfect Financial Transactions

As an Overseas Filipino Worker (OFW) in Dubai, managing finances efficiently is crucial for ensuring that you can support your family back home while handling your expenses abroad. GCash, a leading mobile wallet in the Philippines, has become an indispensable tool for OFWs, providing a secure and convenient platform for various financial transactions. In this guide, we will explore how GCash can benefit OFWs in Dubai and provide tips on how to make the most of this powerful financial tool.

What is GCash?

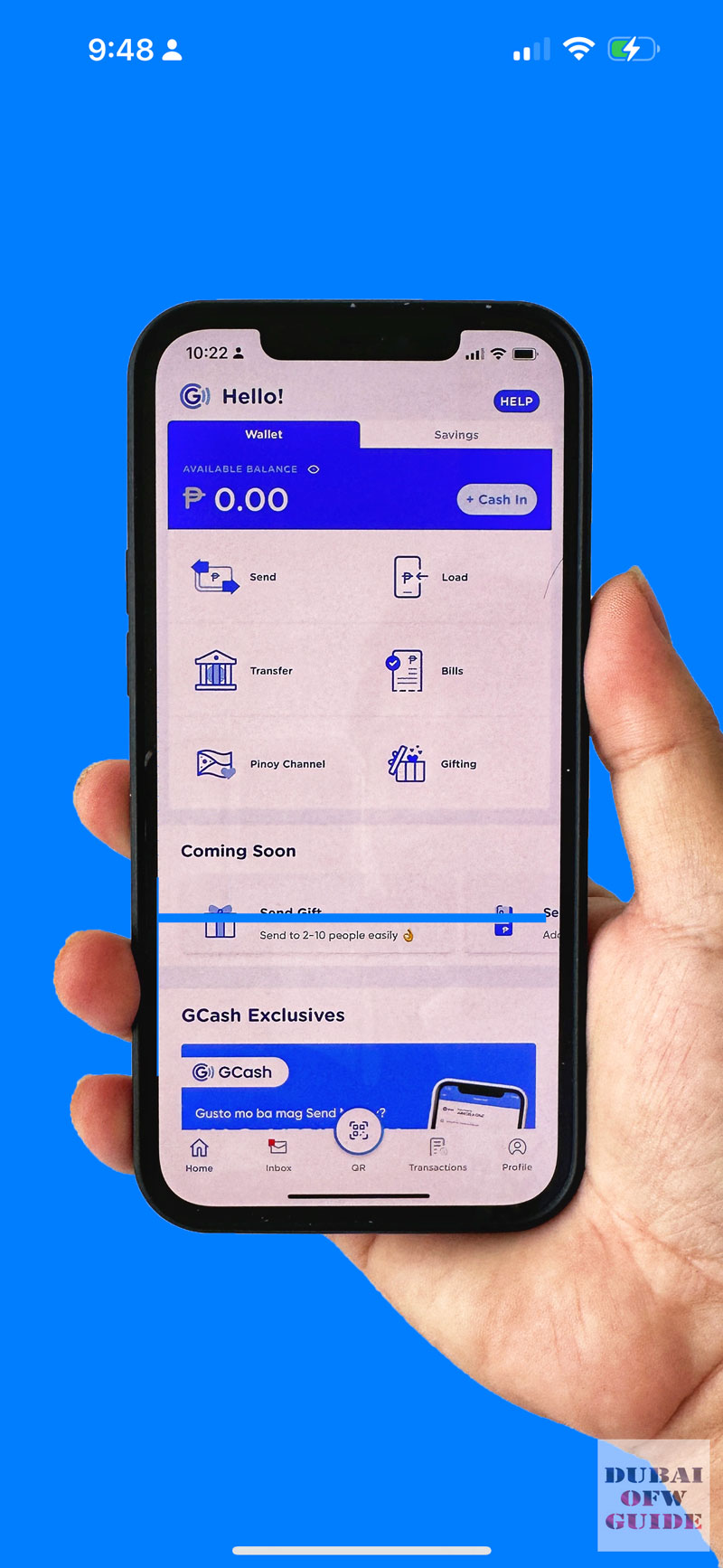

GCash is a mobile wallet service offered by Globe Telecom in the Philippines. It allows users to perform a wide range of financial transactions using their smartphones, including:

- Sending and receiving money

- Paying bills

- Purchasing load for mobile phones

- Shopping online and in-store

- Investing and saving money

- Accessing loans and insurance

Why GCash is Ideal for OFWs in Dubai

GCash offers several advantages that make it an ideal financial tool for OFWs in Dubai:

- Convenience: GCash allows you to manage your finances from the comfort of your home or workplace. With just a few taps on your smartphone, you can send money to your loved ones, pay bills, and even invest.

- Cost-Effective: Traditional remittance services can be expensive due to high fees and unfavorable exchange rates. GCash offers competitive rates and low fees, helping you save money on every transaction.

- Security: GCash uses advanced security measures, including two-factor authentication and biometric verification, to protect your account and transactions. This ensures that your money is safe and secure.

- Accessibility: Whether you are sending money to a bank account or a GCash wallet, the process is straightforward and accessible 24/7. This means you can manage your finances anytime, anywhere.

- Integration with Other Services: GCash is integrated with various services, such as GInvest for investments, GInsure for insurance, and GSave for savings. This allows you to manage all your financial needs in one app.

How to Get Started with GCash

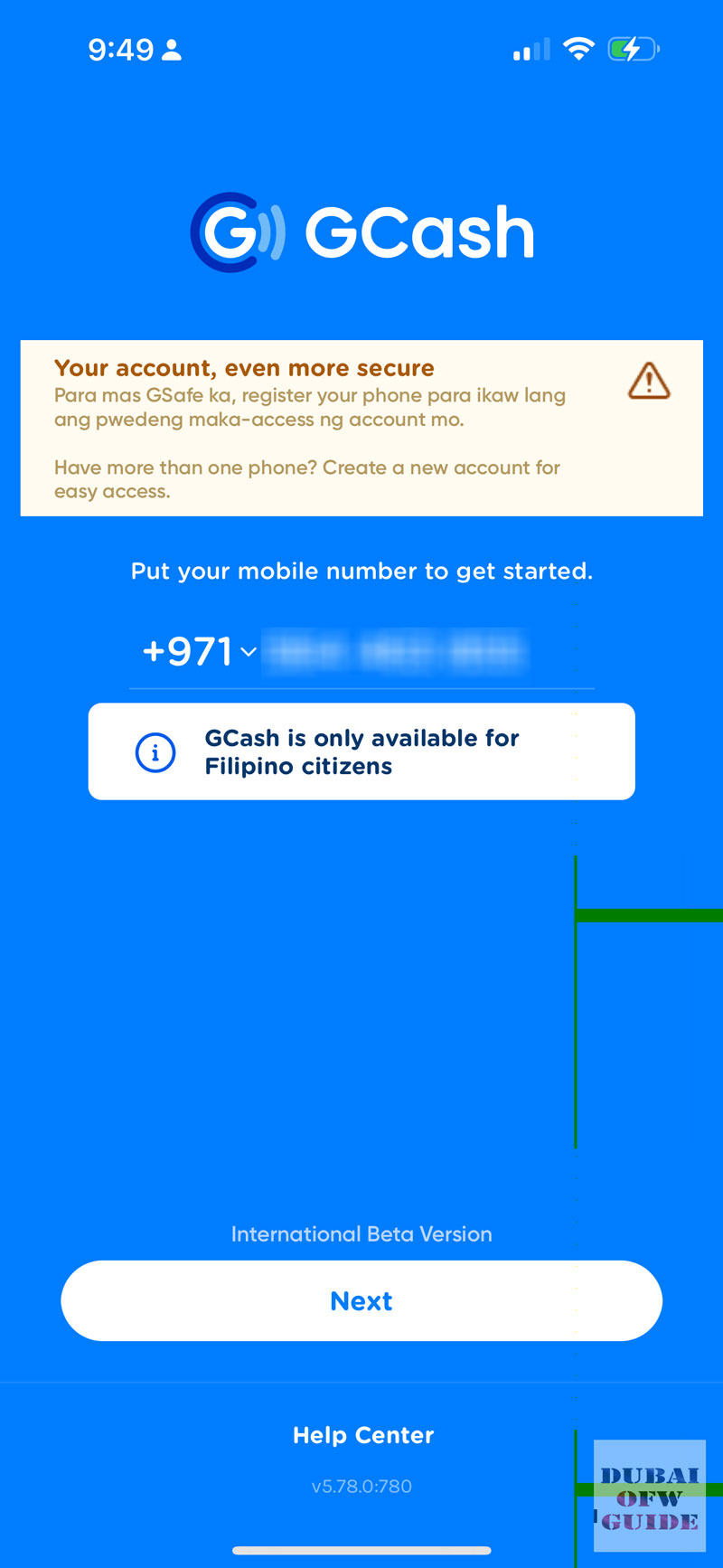

Getting started with GCash for OFW residents in Dubai has never been easier, simple and straightforward. You can now use your UAE Mobile Number to register. Follow these steps to set up your GCash account:

- Download the App: Download the GCash app from the Google Play Store or Apple App Store.

2. Register: Sign up using your Philippine mobile number or UAE mobile number.

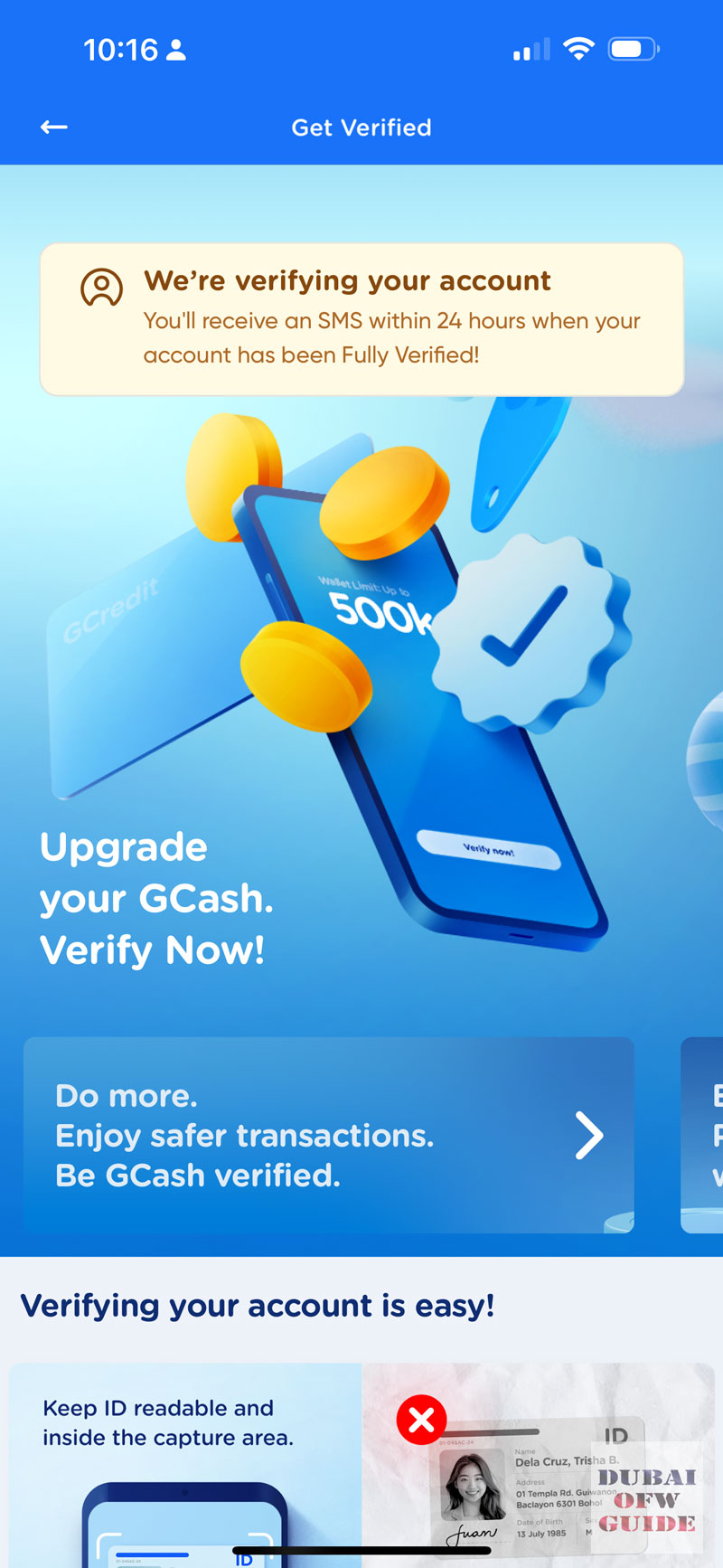

3. Verify Your Identity: Complete the verification process by providing the necessary identification documents. This step is crucial for unlocking the full features of GCash.

4. Link Your Bank Account: Link your Philippine bank account or debit card to your GCash wallet for seamless fund transfers.

5. Add Funds: You can add funds to your GCash wallet through various methods, including online banking, remittance centers, and over-the-counter transactions.

Tips for Using GCash Effectively

To maximize the benefits of GCash, consider the following tips:

- Monitor Exchange Rates: Keep an eye on exchange rates and transfer money when the rates are favorable to get the best value for your remittances.

- Set Up Auto-Deductions: Use the auto-deduction feature for recurring payments, such as bills and insurance premiums, to avoid missed payments and late fees.

- Utilize GSave and GInvest: Take advantage of GSave for high-interest savings and GInvest for investment opportunities. These features can help you grow your money over time.

- Stay Informed: Keep yourself updated with GCash promotions and offers. You can often find discounts and cashback deals that can help you save money on your transactions.

Also Read: Cost of Living in Dubai for OFWs: A Comprehensive Guide

Conclusion

GCash is a powerful tool for OFWs in Dubai, offering a convenient, cost-effective, and secure way to manage your finances. By understanding how to use GCash effectively, you can ensure that your financial transactions are seamless and that you are maximizing the benefits of this versatile mobile wallet. Whether you are sending money home, paying bills, or investing for the future, GCash provides the flexibility and functionality you need to manage your finances efficiently while living abroad.

Pingback: How to Register in GCash for OFWs in Dubai | Dubai OFW Guide