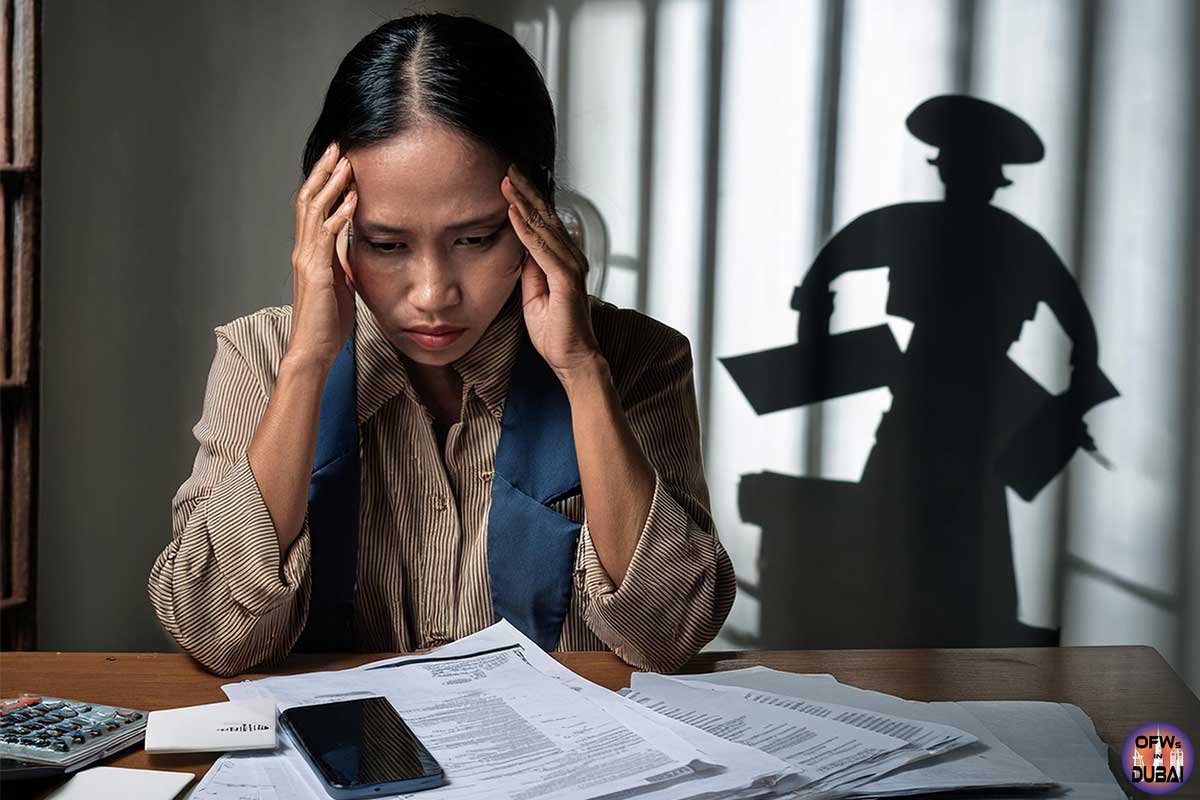

I’ve seen a lot of fellow kababayans/ Overseas Filipinos here in Dubai fall into the debt trap. It starts with getting a loan, which is especially easy here because loan approvals are often fast and convenient. However, things can quickly spiral out of control. Many end up unable to repay the loan, which leads to legal trouble, imprisonment, and even deportation. To help you avoid this stressful situation, I’ve put together practical tips on how OFWs (and other residents) can manage their loans in Dubai wisely.

Tips for OFWs on How to Manage Loans in Dubai and Stay Out of Debt

1. Assess Your Financial Situation

Before applying for any loan, take a moment to assess your financial health. A big part of managing debt is understanding the importance of financial literacy. How much is your salary in Dubai or how much do you earn? What are your monthly expenses? Understanding your cash flow helps you determine how much you can afford to borrow without overstretching your budget.

Tip: Use budgeting apps or spreadsheets to track your income and expenses, and make sure you have enough to cover loan repayments comfortably.

2. Choose the Right Loan Type

Dubai offers various loan options depending on your needs:

- Personal loans for general purposes

- Auto loans for buying a car

- Mortgage loans for property purchases

- Credit card loans for emergency cash advances

Each loan type comes with its terms, so ensure you pick the one that best fits your financial goals. Additionally, learning how to save efficiently can reduce your need to take out unnecessary loans.

3. Compare Interest Rates and Fees

Interest rates can make a massive difference in how much you’ll pay back over time. It’s important to shop around and compare rates from different banks and lenders in Dubai. Some lenders might offer promotional rates, but also watch out for hidden fees like processing charges and early repayment penalties.

Tip: Use online loan comparison tools to quickly check different offers.

4. Borrow Only What You Need

It’s tempting to borrow more money than necessary, especially when loan offers seem generous. However, it’s best to only borrow the exact amount you need. Extra money may seem convenient now, but remember, you’ll have to pay it back—with interest.

5. Set a Repayment Plan

Once you’ve taken a loan, create a repayment strategy. Set monthly reminders for due dates to avoid late fees and penalties. You can also opt for automatic deductions from your salary or bank account if your lender offers this service.

Tip: If possible, pay more than the minimum amount each month to reduce the interest you owe over time.

6. Consolidate Your Loans

If you have multiple loans with high interest rates, consider consolidating them into one manageable payment. Loan consolidation simplifies your financial obligations and can sometimes reduce your overall interest rate, helping you save money in the long run.

7. Avoid Loan Sharks

In Dubai, it’s crucial to avoid unlicensed lenders or so-called “loan sharks.” While they may offer quick cash with minimal paperwork, they often charge extremely high interest rates, putting you in a dangerous financial position. Always choose legitimate banks and licensed financial institutions.

8. Seek Financial Advice

If you’re unsure about managing your loans or struggling with repayments, seek financial advice from professionals. Many banks in Dubai offer free consultations to help you better understand your options. Additionally, you can speak to debt counselors who can guide you through repayment plans and financial management strategies.

9. Be Prepared for Emergencies

Even with the best plans, emergencies can happen. Set aside a small emergency fund to cover any unexpected expenses that might arise during the loan repayment period. This way, you can avoid missing payments due to unforeseen circumstances.

Final Thoughts

Managing loans in Dubai doesn’t have to be a stressful experience as long as you plan wisely. By assessing your financial situation, choosing the right loan, and sticking to a repayment plan, you can maintain control of your finances and avoid falling into debt traps.

Remember, while loans may help meet your financial needs, they should be handled responsibly. Failure to do so may result in consequences, which is one reason why many OFWs remain poor even after going home for good. So, be smart with your money, and always have a plan to pay off what you borrow.