In a dynamic city like Dubai, where opportunities abound, the fear of sudden job loss can be daunting, especially for expats and OFWs who have left their homes in search of a better life. The Involuntary Loss of Employment (ILOE) Insurance scheme is a mandatory safety net designed to provide financial support during such unexpected times. Let’s dive into what this scheme is, how it works, and why it’s essential for residents and expats in the UAE

What is the ILOE Insurance Scheme?

The Involuntary Loss of Employment (ILOE) Insurance is a government-initiated program that offers temporary financial assistance to employees who lose their jobs involuntarily. Whether it’s due to downsizing, restructuring, or company closure, this scheme ensures that affected employees receive a portion of their salary for a limited period, helping them stay afloat while they search for new employment.

How Does It Work?

Employees from the Federal Government and private sector need to register for the ILOE Insurance scheme , pay at a minimal premium and renew it annually or according to the renewal schedule.. These contributions ensure that you are covered if you ever lose your job involuntarily.

Once you lose your job involuntarily, the ILOE scheme provides up to 60% of your average basic salary from the six months prior to unemployment for three months, giving you time to find new employment without the immediate stress of financial instability.

How Much Does ILOE Insurance Cost?

The ILOE scheme is structured into two categories, each linked to an employee’s basic salary.

- Category A is designed for employees earning a basic salary of AED 16,000 and below . This category offers a maximum monthly benefit of AED 10,000. Employees are required to pay a monthly premium of AED 5 or AED 60 per year plus VAT.

- Category B caters to employees with a basic salary above AED 16,000. Under this category, the maximum monthly benefit is AED 20,000. The monthly premium for Category B is AED 10 or AED 120 per year plus VAT.

Insured employees can choose a policy period of either one or two years, with the full VAT amount included in the initial payment. However, benefit pay-outs are limited to a maximum of three consecutive months, and the total claimable amount over an individual’s working life in the UAE is capped at 12 months.

Note: it’s important to pay your premium payment schedule. Missing payments can lead to policy cancellation and penalties. Additionally, maintaining a clean employment record and legal residency status is essential to stay eligible for benefits under the scheme.

How to Register for the ILOE Insurance Scheme

Registering for the ILOE Insurance scheme is straightforward. Here’s how you can do it:

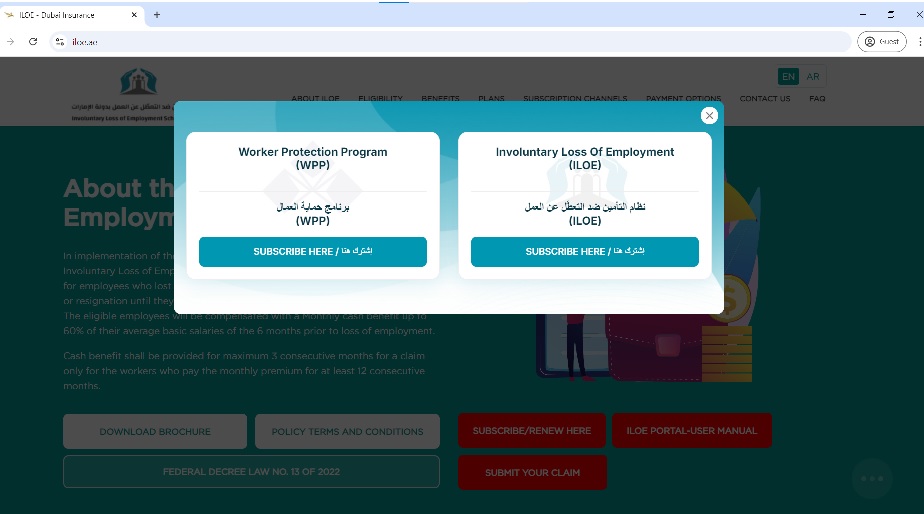

- Visit the Official Portal: Go to the official ILOE registration website or app designated by the UAE government. https://www.iloe.ae/

- Select ILOE: Choose Involuntary Loss of Employment (ILOE)

- Select Your Designated Sector: Identify and select the sector you work in, either in Private, Federal Government and non registered in MOHRE

- Non Registered in MOHRE means sector that is not governed by MOHRE lsuch as DHCC, DIFC or other free zones etc.

- Sign in with OTP: Under sign in with OTP, Enter your Emirates ID, mobile number and Date of Birth to confirm your identity.

- Fill in the Required Information: Provide details such as your employment status, salary, and any other necessary information.

- Choose Your Plan: Select the contribution plan based on your category. The amount you contribute will affect the benefits you receive.

- Make Payment: Complete the payment process using one of the available payment methods.

- Receive Confirmation: After successful registration, you’ll receive a confirmation message or email with your policy details.

- Print your ILOE Certificate: You can also print directly from the website. Go to Policy Details and Click Print

Note: You can also go to your nearest Al Ansari Exchange or government business centers such as Tasheel or Tawjeeh. Bring with you your Emirates ID and Mobile number for OTP purposes.

Also Read: Basic Labour Laws in the UAE You Need to Know

How to Renew Your ILOE Insurance

Renewing your ILOE scheme is just as important as the initial registration. Here’s how to do it:

- Log In to Your Account: Visit the ILOE portal and log in using your Emirates ID and Mobile Number

- Review Your Current Plan: Check your current plan details and decide if you want to continue with the same plan or make changes.

- Update Information: If there have been changes in your employment status or salary, update these details.

- Make Payment: Proceed with the payment for renewal. Ensure that your contributions are up to date to avoid any lapses in coverage.

Requirements to Claim ILOE Insurance

The ILOE scheme is available to all employees in the Federal Government, Private Sectors and Free Zones in Dubai, including OFWs, as long as they meet certain criteria:

- Active Contribution: You need to have been regularly contributing to the ILOE Insuracne scheme for at least 12 months during your employment.

- Involuntary Job Loss: The job loss must be involuntary, meaning employment dismissal or termination is due to the following company decisions:

- Company Downsizing

- Company Restructuring

- Company Closure

- Note: Termination of Employment should not be due to resignation, disciplinary action or misconduct, or non-peaceful labor actions, such as strikes or stoppages

- Legal Residency Status: You must be legally residing in the United Arab Emirates at the time of the claim.

- Timely Claims Submission: Submit claims within thirty (30) days following the end of your employment or after the resolution of any labor disputes that have gone to court.

- No Abscondment Complaints: Ensure that there are no outstanding abscondment complaints against you.

- Fraud-Free Claims: Your claim must be free of any fraudulent or deceptive practices, and the employer must be a legitimate company.

Also Read: Employment Contracts in the UAE: What You Need to Know

Steps to Avail ILOE Benefits:

- Log in the ILOE Portal: Go to ILOE website, login with your Emirates ID and mobile number.

- Report Involuntary Job loss: Click claim and provide necessary documents, such as proof of employment, termination letter, and any other required paperwork.

- Receive Payments: If approved, you will start receiving payments based on your eligibility and contribution history.

Why is the ILOE Scheme Important for UAE Employees?

Losing a job can be particularly challenging. The ILOE scheme offers a crucial safety net by providing temporary financial support. This assistance is especially valuable in a foreign country, where job hunting might take longer and where financial obligations back home continue to mount.

Limitations of the ILOE Insurance

While the ILOE scheme provides valuable financial support during periods of involuntary unemployment, there are certain limitations to be aware of:

- Benefit Duration:

The insurance benefits are capped at three consecutive months per claim. You can receive a maximum of 12 months of benefits throughout your working life in the UAE. - Benefit Cap:

The scheme provides up to 60% of your average basic salary from the six months prior to unemployment. However, the maximum monthly payout is AED 10,000 (USD 2,723) for Category A and AED 20,000 (USD 5,446) for Category B. - Eligibility Restrictions:

You must meet specific eligibility criteria, such as maintaining a clean employment record, paying your premiums on time, and legally residing in the UAE at the time of your claim. - Exclusions:

The ILOE scheme does not cover job losses due to resignation, misconduct, or involvement in non-peaceful labor actions like strikes or stoppages. Additionally, fraudulent claims or those from employees of fictitious companies are not eligible for benefits. - Abscondment Complaints:

If you have any outstanding abscondment complaints, you will not be eligible for ILOE benefits. - Non-Mandatory for Certain Groups:

- The ILOE scheme is not mandatory for:

- Investors (owners of companies they work at)

- Domestic helpers

- Temporary-contract workers

- Juveniles under the age of 18

- UAE locals who have fulfilled the conditions for referral to retirement or retirees entitled to a pension who have joined a new job

- The ILOE scheme is not mandatory for:

Also Read: OFW Rights During the Probation Period in Dubai

Frequently Asked Questions (FAQs)

1. Is the ILOE scheme mandatory for all employees? Yes, the ILOE scheme is mandatory for all employees in Dubai, including OFWs. Employees are required to enroll themselves in the scheme and make regular contributions.

2. How much of my salary will I receive under the ILOE scheme? The amount you receive will be 60% of the average basic salary over the six months prior to unemployment.

3. How long will the ILOE benefits last? The benefits pay-outs are limited to a maximum of three consecutive months, and the total claimable amount over an individual’s working life in the UAE is capped at 12 months.

4. What happens if I resign from my job? If you resign voluntarily, you will not be eligible to receive benefits under the ILOE scheme. The scheme is designed to assist those who lose their jobs involuntarily.

5. Can I still receive ILOE benefits if I find a new job during the payout period? Generally, the benefits stop once you find new employment. However, the specifics can vary, so it’s essential to check with the relevant authorities.

6. How do I ensure that I am covered by the ILOE scheme? Ensure that you are enrolled in the scheme and that contributions are being made regularly from your salary.

7. What happens if I don’t pay my ILOE contributions on time? You have a three-month grace period to pay outstanding contributions. If not paid within this period, your policy may be cancelled, and you could face penalties. To reinstate, you’ll need to pay any outstanding premiums and fines.

8. How will I know if my ILOE insurance is expiring? Check your policy details on the ILOE portal or documents. Set reminders a few weeks before expiration, and look out for notifications from ILOE. You can also contact customer support for confirmation.

Conclusion

The Involuntary Loss of Employment (ILOE) scheme is a vital program that offers peace of mind to workers in the UAE, including OFWs. By providing financial support during periods of unexpected job loss, the scheme helps individuals maintain their livelihood while searching for new opportunities. Make sure you’re informed and contributing to this mandatory safety net to secure your future in case the need ever arises.